Summary

This is the inspiring story of Jack Thompson, a man who went from financial ruin to building a multi-million-dollar real estate empire. Facing overwhelming debt and no clear career path, Jack discovered the power of real estate investment. Through perseverance, calculated risks, and learning from failure, he turned his life around. Today, Jack is not only a successful real estate mogul but also a mentor to aspiring investors. His journey offers valuable lessons about resilience, smart investing, and the opportunities that can be found in adversity.

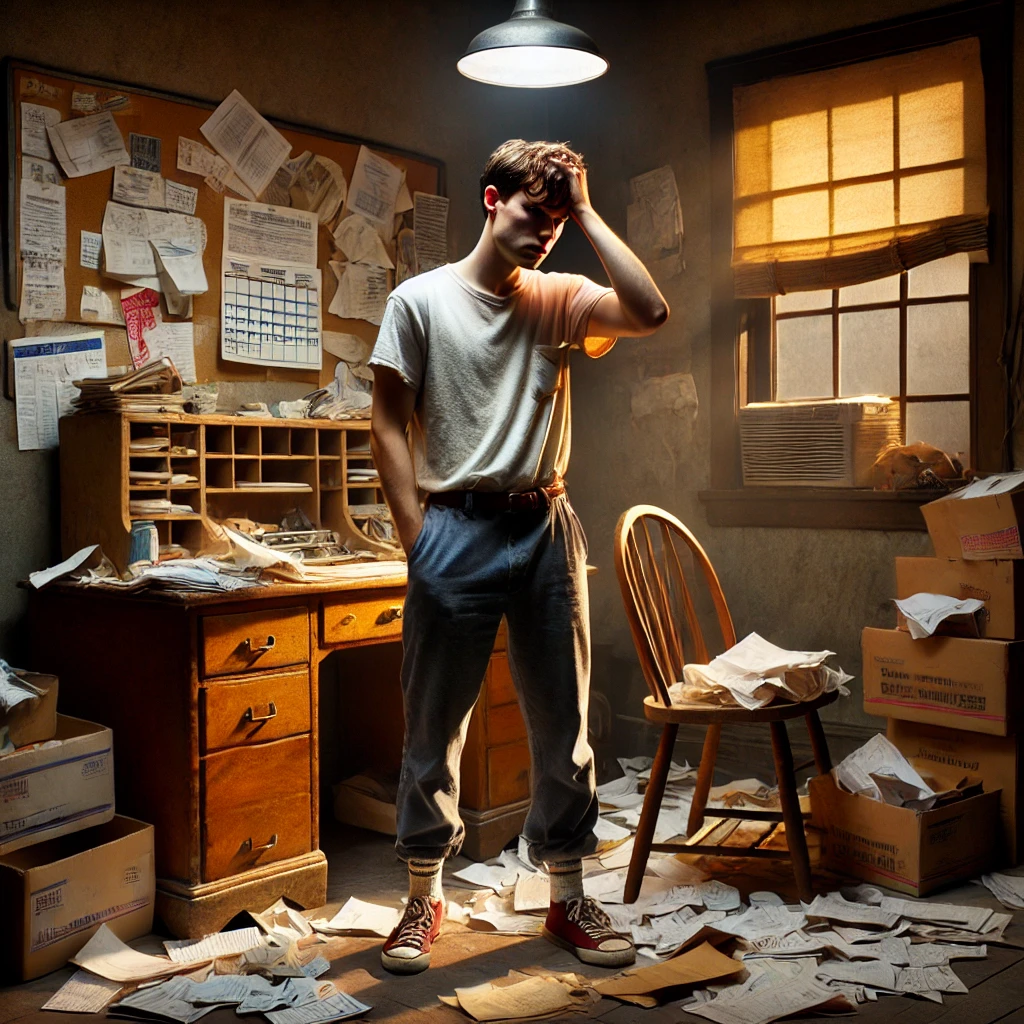

Early Struggles: Jack’s Fight to Survive

Jack Thompson grew up in a working-class family, where financial struggles were a constant. Although his parents worked hard, they never accumulated savings or investments, and Jack was not equipped with financial literacy growing up. After graduating with a marketing degree from a small state university, Jack entered the workforce full of optimism. Unfortunately, he soon discovered the harsh realities of the job market.

Unemployment and Debt

After bouncing from one dead-end job to another, Jack soon found himself living paycheck to paycheck. Student loans, credit card debt, and basic living expenses became overwhelming. When Jack lost his job during the 2008 recession, he hit rock bottom—no savings, no job, and no clear path forward.

Taking Control

Realizing that his financial situation wouldn’t change unless he took control, Jack made the decision to shift his focus toward entrepreneurship. His path to financial freedom would begin when he accidentally discovered the opportunities available in real estate.

Discovering Real Estate: A New Beginning

Amidst the 2008 financial crisis, Jack stumbled upon an opportunity that would change his life forever. While helping a friend move out of a foreclosed home, he saw the housing market collapse firsthand. But where others saw disaster, Jack saw potential.

Learning the Ropes

Despite having no experience in real estate, Jack immersed himself in learning everything he could about property investing. He attended free seminars, read books, and sought advice from experts. Soon, he developed a strategy focused on distressed properties and foreclosures, where low prices created enormous opportunities for those willing to take risks.

The First Deal: A Leap of Faith

The Purchase

Jack’s first real estate purchase was a distressed duplex in a low-income neighborhood. Using a combination of personal savings and a small loan, Jack bought the property for $40,000. The property was in poor condition, but Jack was determined to turn it around.

DIY Renovation

Unable to afford professional contractors, Jack took on the renovation himself. He spent months learning basic repair skills and doing everything from plumbing to painting. His hard work paid off as he managed to rent out both units, creating a small but steady stream of income.

Building Confidence

That first deal wasn’t a massive success financially, but it gave Jack the confidence and experience to pursue bigger opportunities. The duplex became the foundation of what would later be a vast real estate portfolio.

Building the Empire: Scaling Up

Reinvesting Earnings

Jack’s strategy was simple—reinvest every dollar he earned back into more real estate. He continued purchasing foreclosed and distressed properties, renovating them, and either renting them out or flipping them for profit. His reputation grew, and banks began offering him more favorable financing, enabling him to take on larger projects.

Expanding into Multi-Family Units and Commercial Real Estate

By reinvesting his profits and growing his network of investors, Jack expanded his portfolio to include multi-family units and even commercial real estate. His focus on undervalued properties allowed him to grow rapidly, and by his mid-30s, Jack’s portfolio was valued at over $10 million.

Overcoming Setbacks: Learning from Failure

The $100,000 Mistake

Despite his success, Jack faced significant setbacks along the way. One of his most challenging experiences came when a large renovation project went wrong. A contractor failed to deliver on time, leading to months of delays and cost overruns. Jack ultimately lost $100,000 on the deal.

Learning and Adjusting

Rather than letting the loss discourage him, Jack treated it as a learning experience. He tightened his process for vetting contractors and built a stronger team for future projects. He also learned the importance of detailed planning and budgeting, which helped him avoid similar mistakes in later deals.

The Importance of Cash Flow

Through these experiences, Jack learned that the key to long-term success in real estate is cash flow. Instead of focusing solely on flipping properties for quick profits, he emphasized building a portfolio of rental properties that provided steady monthly income. This strategy gave him the financial stability to take on bigger risks while minimizing the impact of market downturns.

Giving Back: Mentorship and Legacy

Mentoring Aspiring Investors

With his financial success secure, Jack turned his attention toward helping others. He began speaking at real estate conferences and teaching seminars, sharing his knowledge with those just starting out in the industry. Jack’s story became a source of inspiration for new investors, showing that even those with little money and no experience could achieve financial freedom.

Establishing a Scholarship Fund

In addition to mentoring, Jack also created a scholarship fund to support underprivileged students interested in pursuing careers in real estate and entrepreneurship. He believes in giving back to the community and helping others find the opportunities that transformed his own life.

Future Plans: Expanding the Empire

Urban Developments and International Real Estate

Jack isn’t content to rest on his laurels. He has plans to expand his real estate empire even further, exploring opportunities in urban developments and international markets. His vision is to leave behind a lasting legacy that extends beyond financial success.

Building a Lasting Legacy

“I want to keep growing, but my focus now is on building a legacy,” Jack says. “I want to leave something behind that will last beyond my lifetime. Real estate changed my life, and I want to help others see that it can change theirs, too.”

Resume

Name: Jack Thompson

Starting Point: Broke, unemployed, and $50,000 in debt

Initial Investment: $40,000 duplex (purchased with savings and a small loan)

Current Net Worth: $15+ million

Key Strategies:

- Focus on foreclosures and distressed properties

- Self-learning and self-management of renovations

- Building cash flow through rental properties

- Scaling investments into multi-family units and commercial real estate

Major Setbacks: Lost $100,000 on a large renovation project

Mentorship: Provides coaching and scholarships for aspiring investors

Future Goals: Expand into urban developments and international real estate

Jack’s story is a testament to the fact that with the right mindset, a willingness to learn, and persistence through adversity, anyone can turn their financial situation around and build a prosperous future.